The Federation endowment delivers best-in-class performance

By Lewis Gaines

LVJF Investment Chair

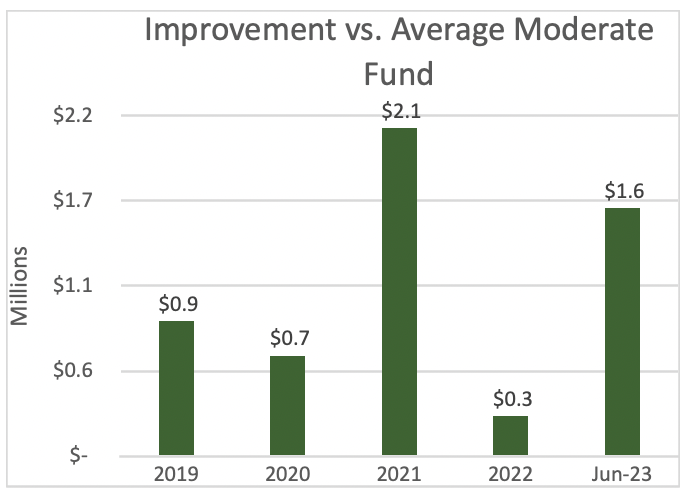

Our June 2023 YTD return of 11.5% was dramatically higher than the Moderate Allocation Index benchmark return of 6.9%. Our portfolio has outperformed for more than 10 years in both up and down markets. Since 2019, our low-cost, S&P focused index strategy has generated investment gains of $13.3 million which are $5.6 million higher than the average similar-risk fund. As of June 2023, Foundation assets totaled about $40 million, of which $17 million was invested on behalf of community agencies.

The endowment’s long-term returns not only greatly exceed our benchmark, but are also substantially above the returns of most small and large endowments. In the context of expected long-term returns of 8 to 9%, the demonstrated multiple-year return differences of 190 to 470 basis points are highly significant and have led to the $5.6 million in outperformance versus the average moderate-risk fund.

Our outperformance resulted from:

- A focus on maintaining target exposure to stocks and not reacting to changes in investor mood and the always volatile economic and political news

- Heavy weighting to the S&P index as large-cap growth stocks have outperformed other equities

- A higher than benchmark target equity allocation (68% versus 60%), which generates higher returns in the long run

- No foreign stocks, which have significantly underperformed US stocks for many years

- Periodic reallocation between stocks and bonds to take advantage of both major short-term fluctuations and long-term trends Israel Bonds, which limit fluctuations (both up and down) in our investment-grade bond portfolio while paying higher interest than U.S. Treasury Bonds

- Low advisory fees and a completely indexed equity portfolio

Goldman and the investment committee continue to monitor our portfolio closely. We both believe that the Jewish Federation of the Lehigh Valley is well positioned to continue with better than average returns.

DECEMBER 2022 UPDATE INDEX